First Quarter 2015 Pierce County Housing Report

We appear to be in for a wild ride in 2015 when it comes to the Pierce County Housing Market! So how do you navigate it if you are a seller?! What are the best strategies for a Buyer to get the home they really want? I'll discuss that and more in this article but as always let's start with the Pierce County numbers as of March 31st.

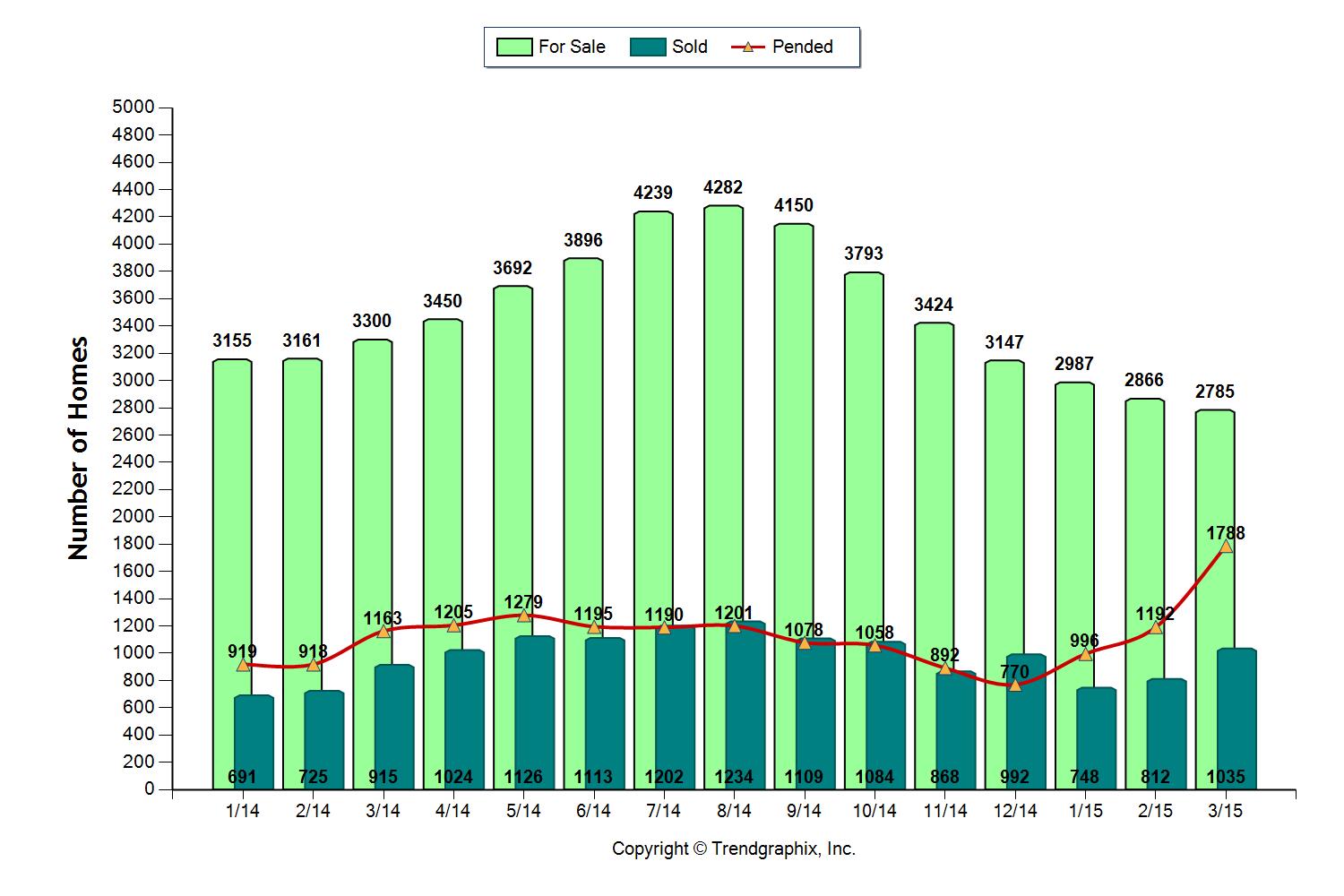

Inventory – DOWN – 15.6%

Closings – UP – 13.1%

Median Price – UP – 8%

New Pending Contracts – UP – 53.7%

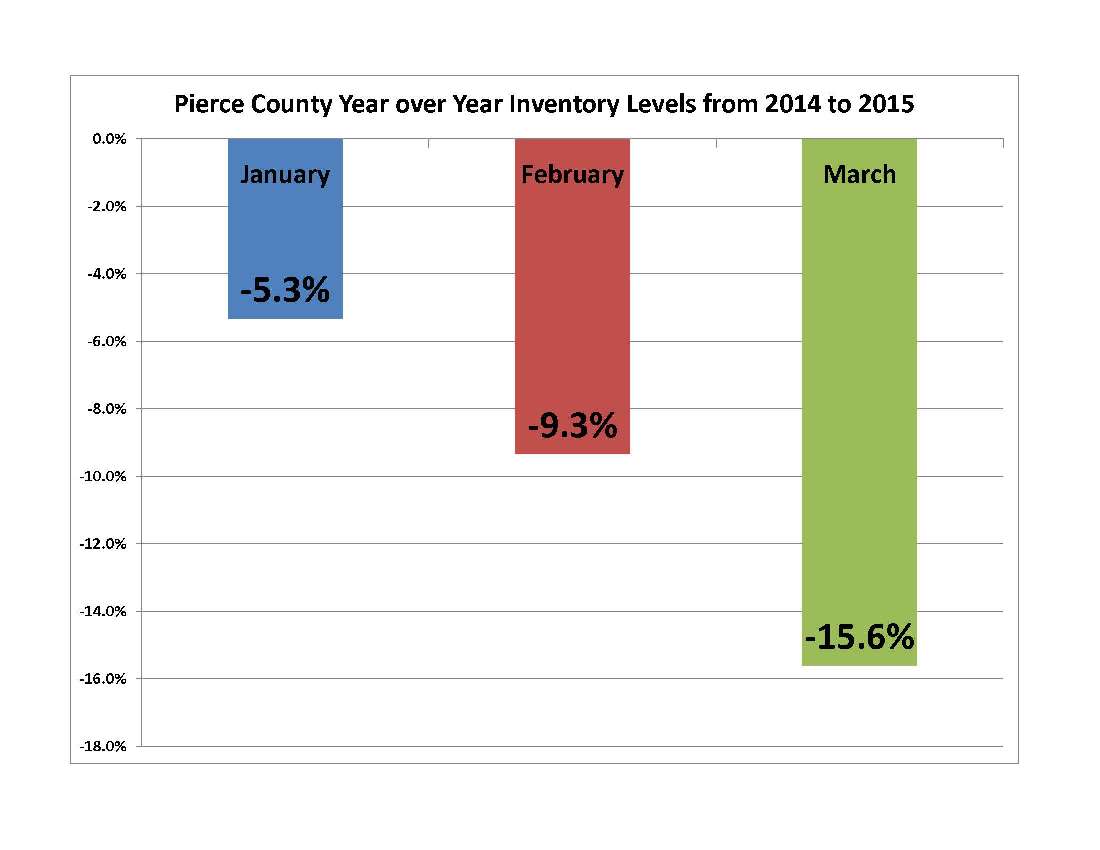

These Year over Year numbers tell us the market is hot, in fact the Months of Inventory (MOI) is at 2.7 based on last month's closed sales. This is the lowest since Q3 of 2005. Anytime the month's worth of inventory dips below 3 months we have a market environment that favors sellers and encourages price appreciation. Also, year over year inventory levels have been declining steadily in Pierce County so far this year.

The primary reason for these dramatic declines comes as no surprise…Pierce County home buyers have been busy! There may not have been much snow in the NW mountains this year but our Pending home sales chart looks like a ski jump with Pending sales up 33% for Q1! Inventory is the biggest key to how our market plays out for the balance of 2015.

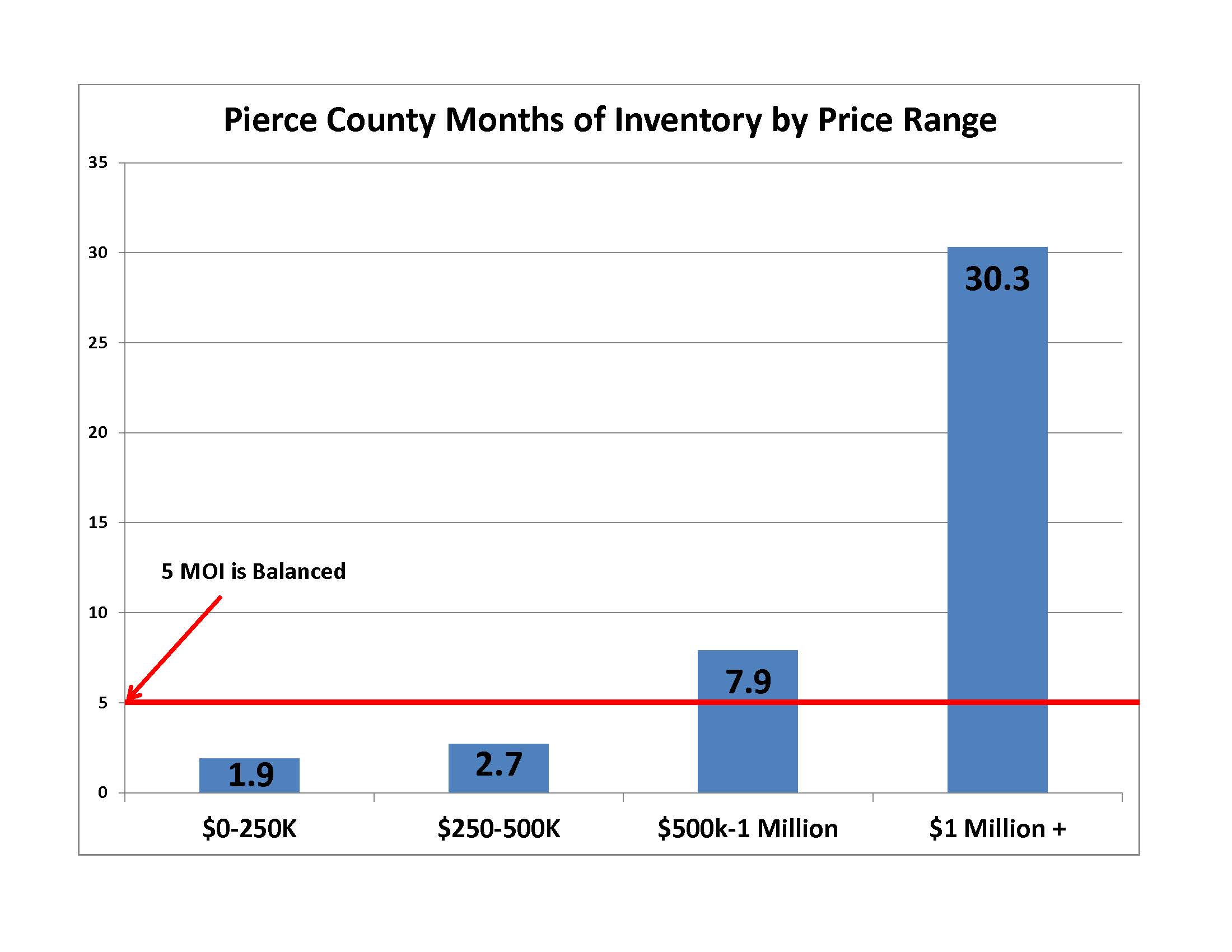

So inventory is down and sales volume is rocketing. "If I want to sell my house I can ask whatever I want and buyers will flock to my door…right?!?" Not so fast! The answer is…."It depends". Turns out, like so many things in the world of statistical sound bites, there are some distinct differences in the experience you can expect as a buyer or seller depending on what price range you are in. Bear with me as I set this up.

There are 2 data points when evaluating a market that are, IMHO, the most valuable predictors of what to expect as a buyer or a seller. One is the Sales Ratio; I explained the Sales Ratio in a blog last year, if you want to refresh you can link to it here . In a nutshell 55% is a balanced market, the higher the sales ratio number, the hotter the market, and the more likely things are in favor of the seller. The second number is Months of Inventory (MOI), with this indicator the lower the number, the more likely is that sellers are in control. Low MOI says at the current sales pace the market will "run out" of inventory if new properties don't come available or demand slows down.

Overall PC has a sales ratio of 64% and MOI of 2.7. Both numbers tip in favor of sellers. Combined with the trends discussed in my opening remarks you'd think it's time for prices to move higher across the board. If you are working with homes under $500,000 you'd be absolutely right..you may even be accused of understating the situation, but if the home is over $500,000 it may require a closer examination. Take a look at the following;

Millennial buyers, first time buyers, investors, and more are super heating the market under $250,000. I would argue that a 90% sales ratio is not even sustainable, prices have to increase to temper the demand and allow the inventory level of only 1.9 months supply to eventually come back in line. A buyer in this price range needs to choose a broker well networked and steeped in local knowledge. One that is plugged into technology that receives quick market alerts and is accessible; able to move quickly for you when good properties come available. In this price range the broker needs to be able to advise you on how to groom your offer for greater likelihood of acceptance without giving away important rights you need as a buyer and ensuring your transaction is financially safe.

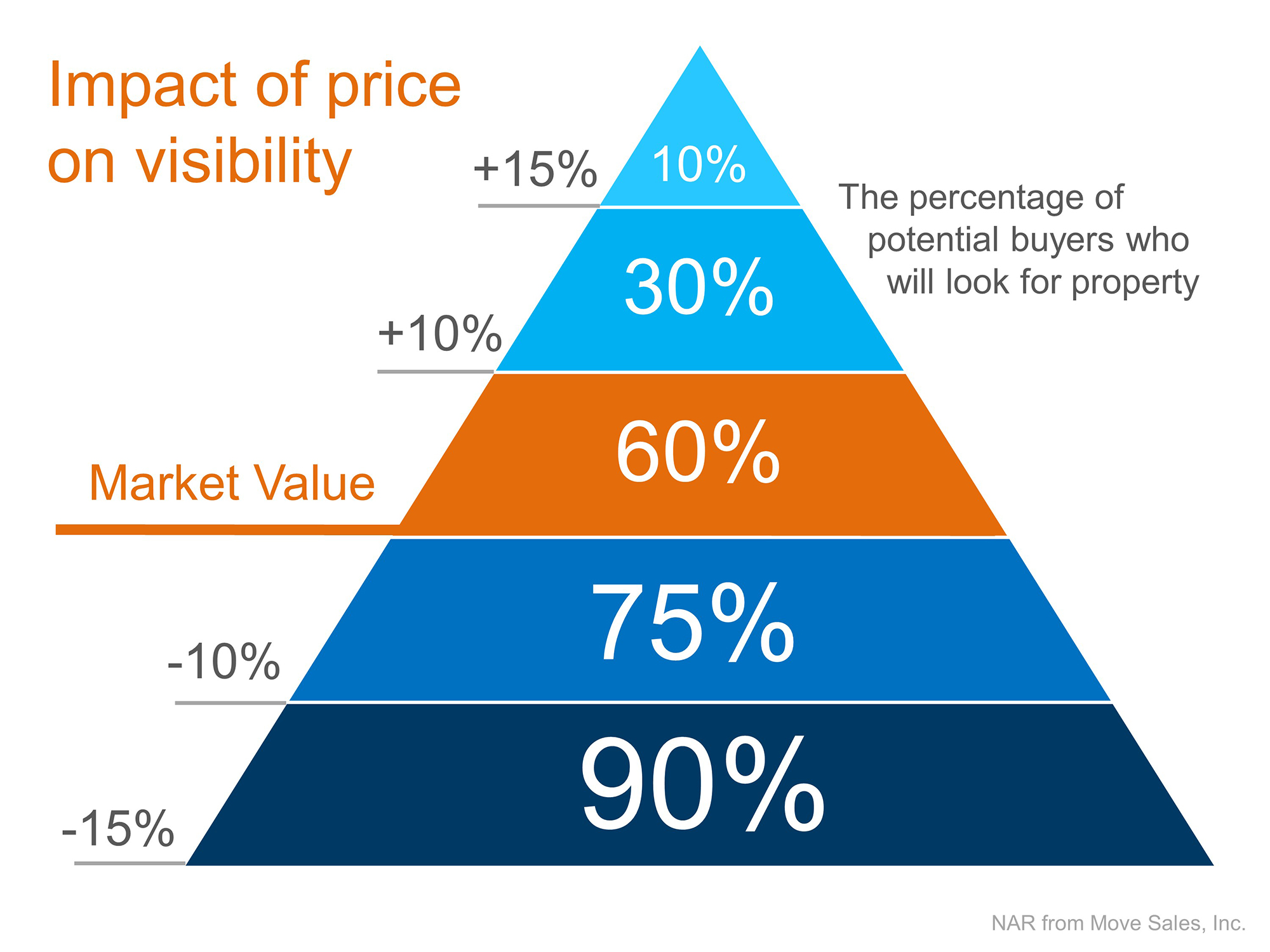

Conversely, between $500,000 and $1,000,000 a 21% Sales Ratio and almost 8 months of inventory is not a market condition that pushs prices up. Sellers here need to carefully evaluate their pricing strategy based on sound data that their broker can provide. If the Pierce County home is in the higher end, they are likely entering a market crowded with competition and it is worth considering the Impact of Price Visibility as shown on this chart;

The other take away I see in these numbers is the fact that if you're worried about finding your new dream home after selling the one you're in now, it may not be a concern if you are moving up into a larger or more deluxe dwelling.

In this ever dynamic market, sound professional advice and guidance is key to your real estate success. One newspaper or newscast headline does not fit all, and without local expertise with real time data it is easy to mis-step in such a fast paced real estate market.

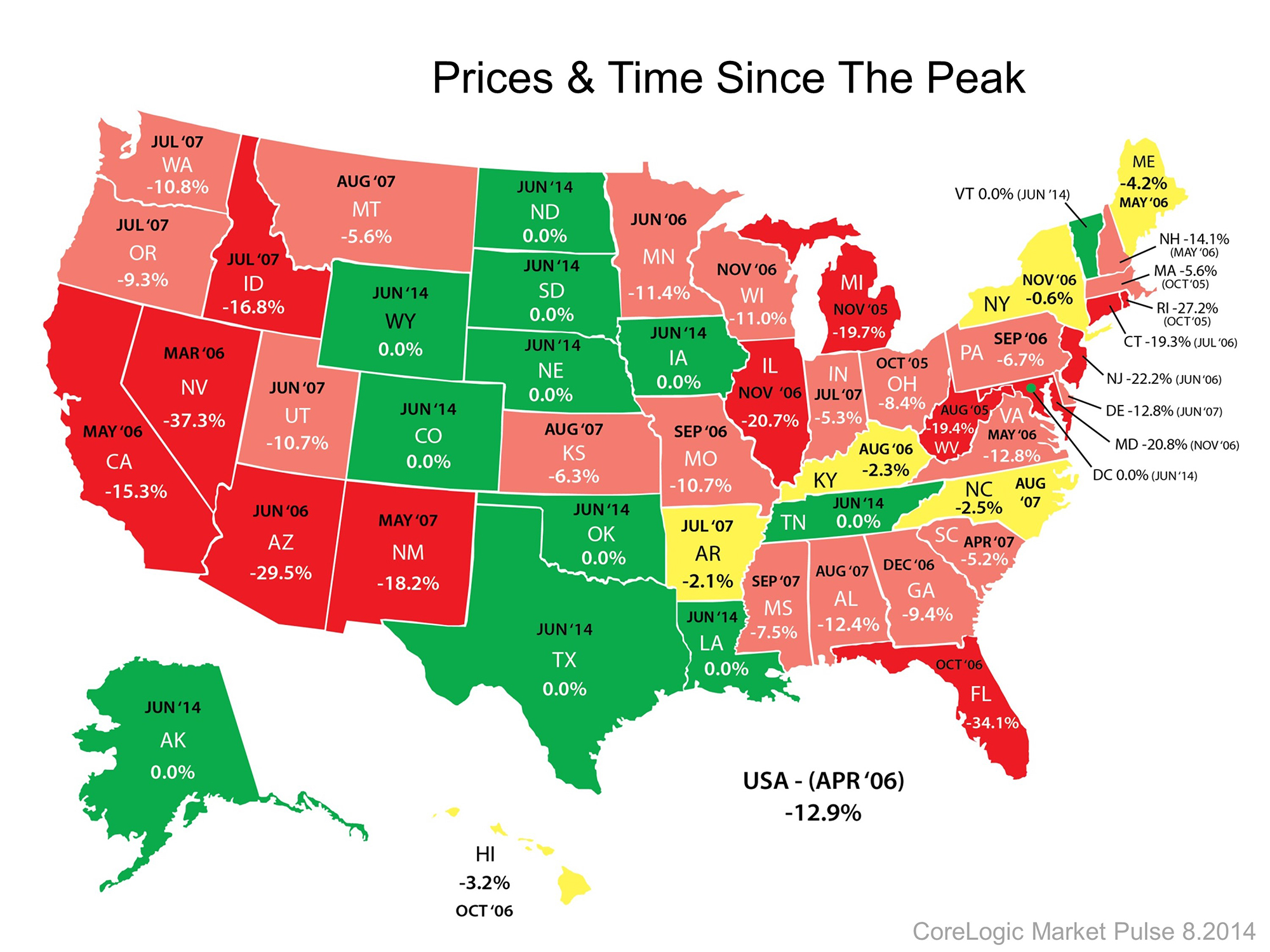

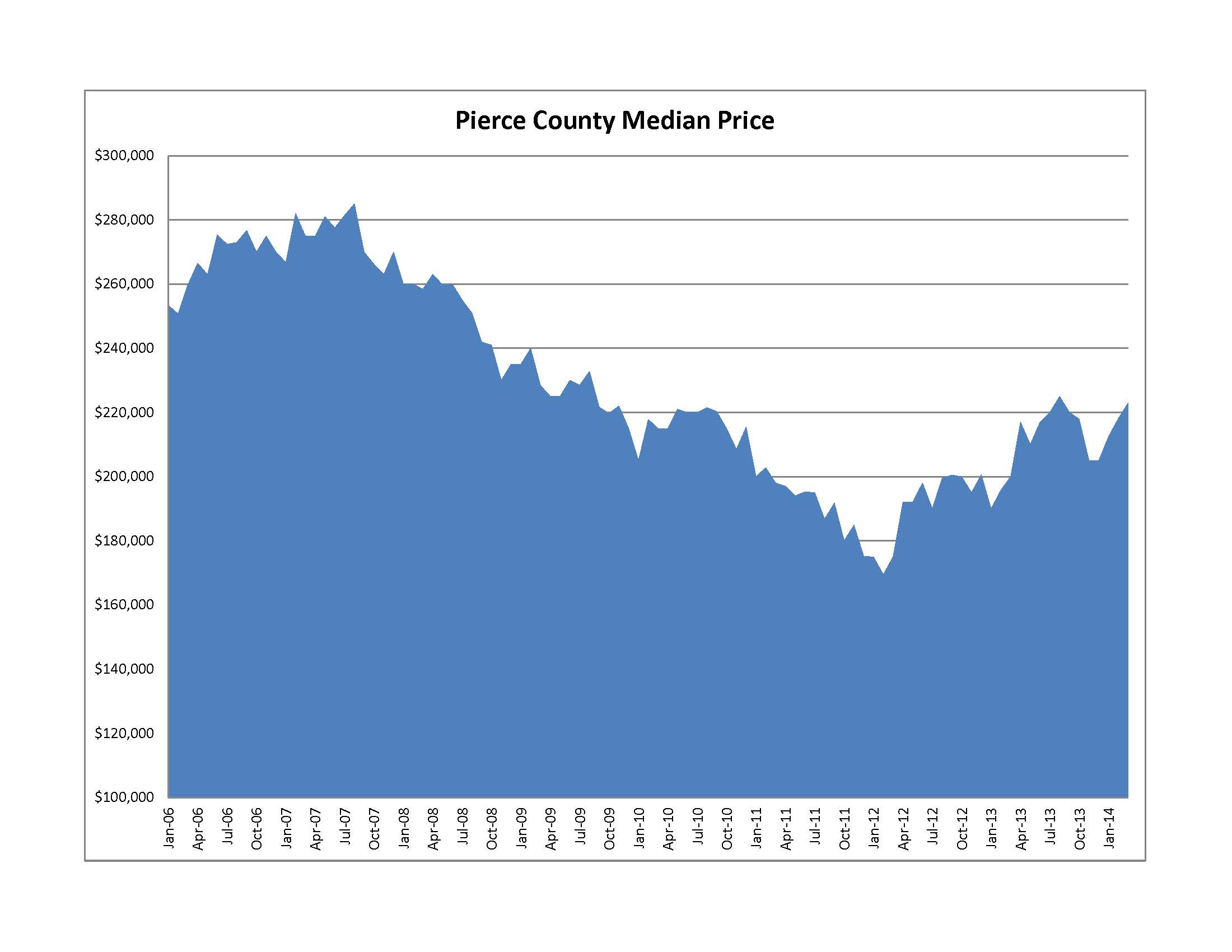

Pierce County Real Estate continues to lag behind King County

The Pierce County real estate market continues to lag behind King County, but there is light at the end of the tunnel and values are approaching 2004 – 2005 levels. For more details see the full article that was on yesterday's front page of the News Tribune.

Thousands in Pierce County trapped in underwater mortgages

Spring 2014 Pierce County Housing Report

Normalization continues, look who's buying and selling!

And where are rates headed?

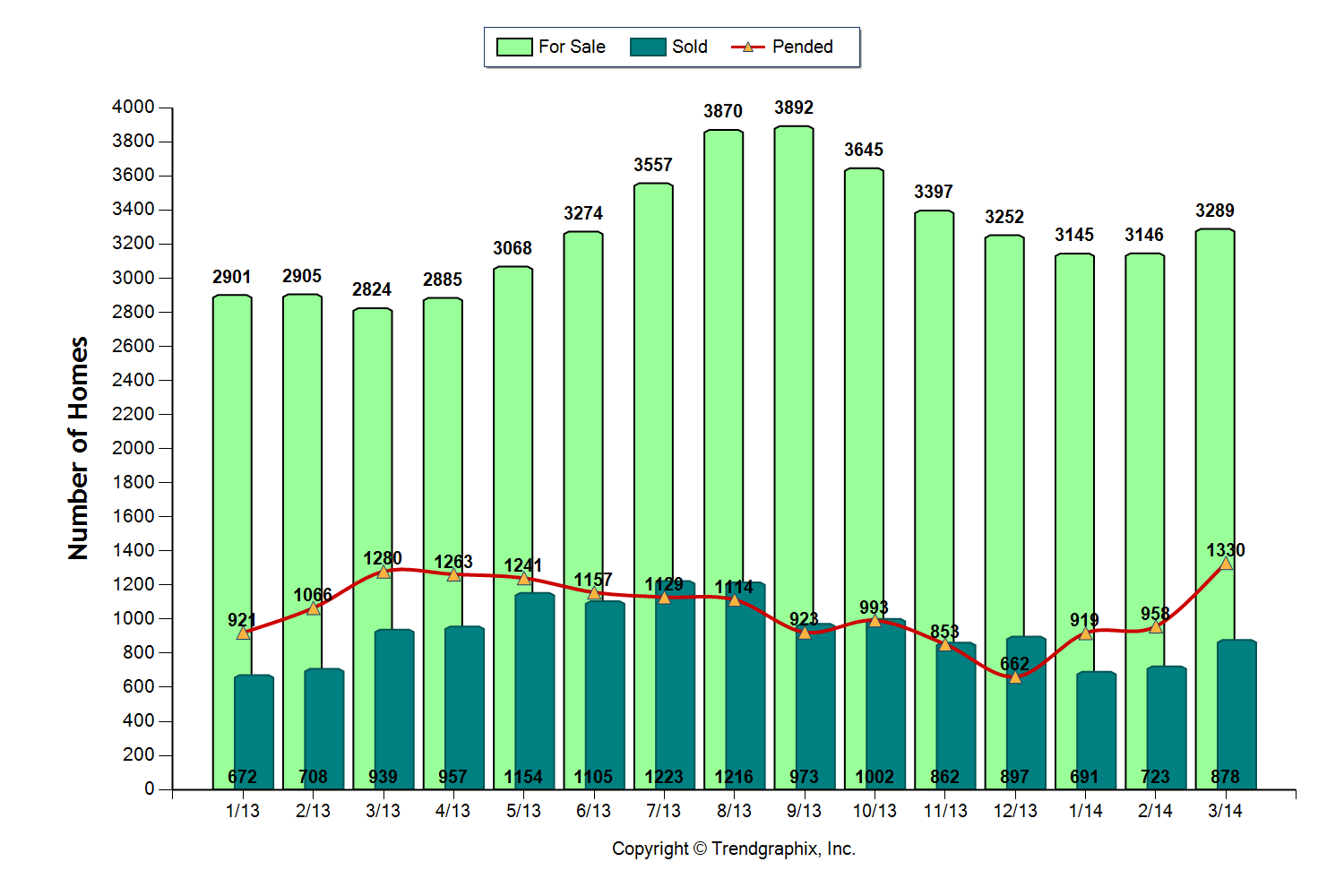

The Pierce County Housing Market as measured by April 2014 numbers looks pretty benign and one might be tempted to believe the national headlines that the market is slowing down. Not so fast! Here are the numbers followed by a look inside the data that might surprise you!

Inventory – UP +17%

Closings – Down -7%

Pending Sales – UP +4%

Months of Inventory – UP last year 3 this year 3.7

Median Price – UP 13%

The stats above are not too impressive, maybe indicating the Pierce County Housing Market is neutral, and in a sideways crawl. To be honest I thought the same at first, and that is why I didn't check in with my report last month (My apologies to the 4 of you that missed it! lol!). Sometimes the real story is inside the numbers.

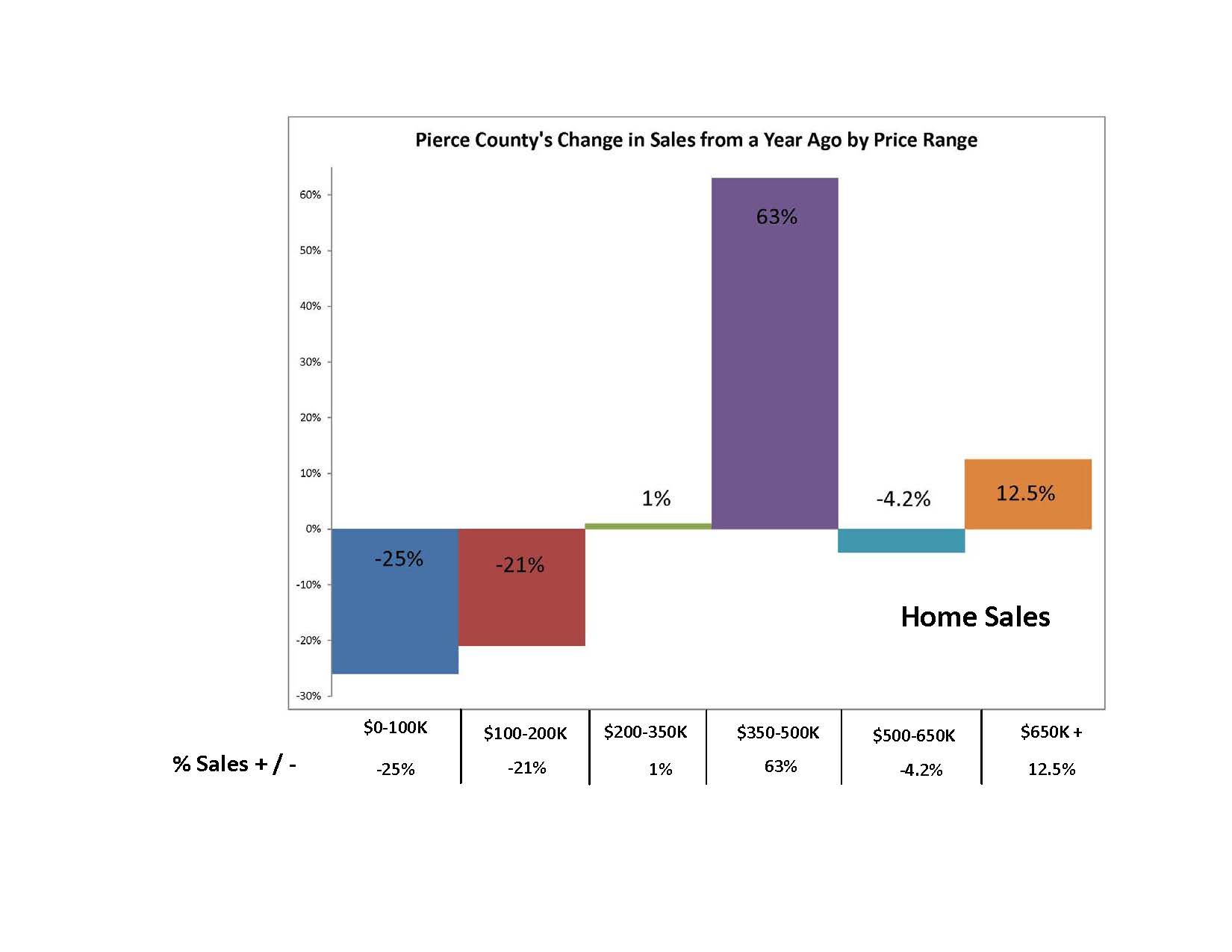

Normalization of the Pierce County Housing Market is evident. With falling distressed sale transactions and a substantial increase in upper end price ranges. This tells the story of the return of repeat sellers willing to resume participation in the market. Take a look at the breakdown of Pierce County sales by price range and what jumps out is the spike on the $350,000 to $500,000 price range.

Although the overall numbers are not showing the big year over year gains we watched for most of last year, we can safely observe the market is more balanced and not just fueled by first time buyers and investors. Look below at how the makeup of sales is trending as measured by April numbers.

Although the overall numbers are not showing the big year over year gains we watched for most of last year, we can safely observe the market is more balanced and not just fueled by first time buyers and investors. Look below at how the makeup of sales is trending as measured by April numbers.

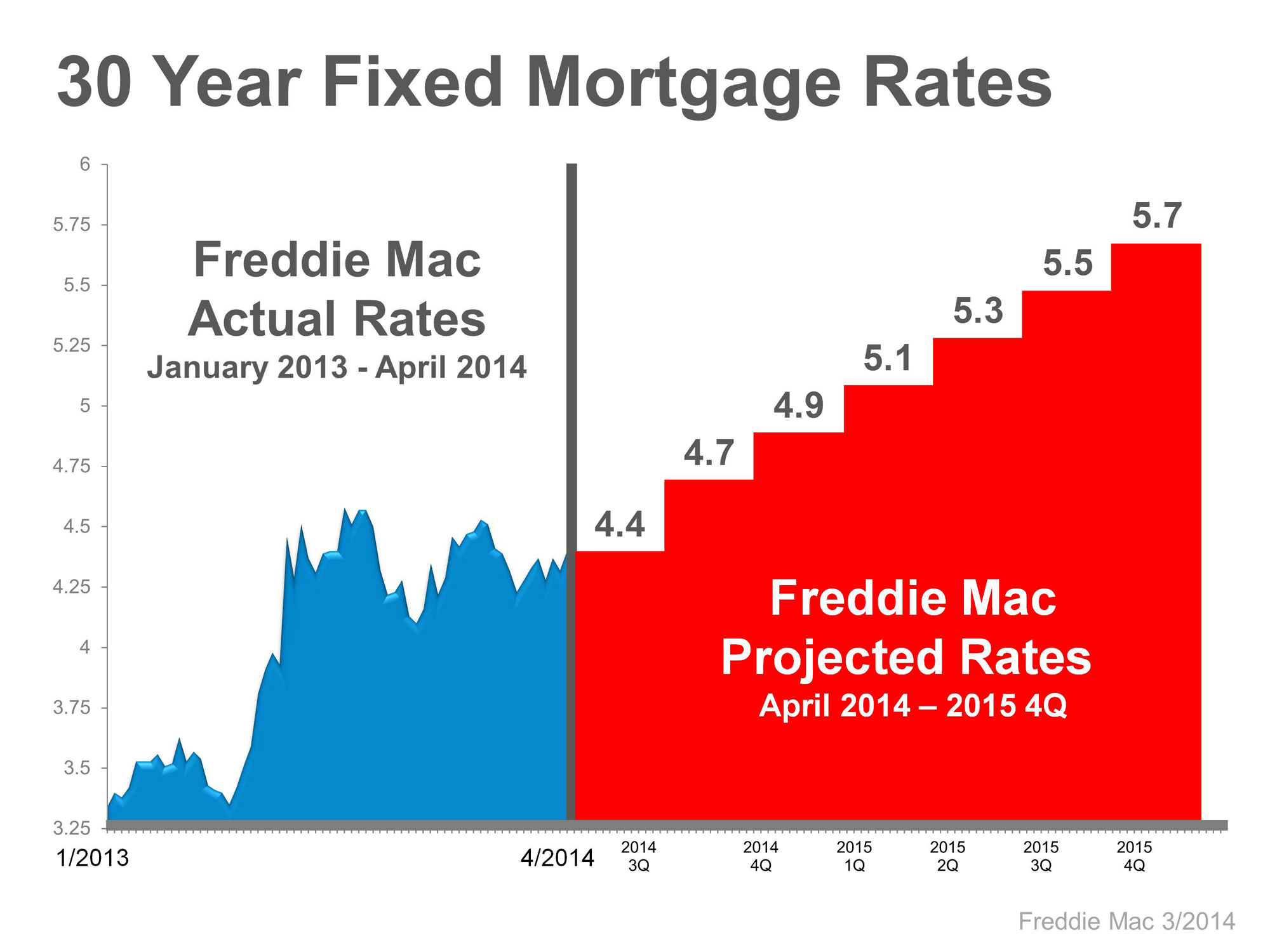

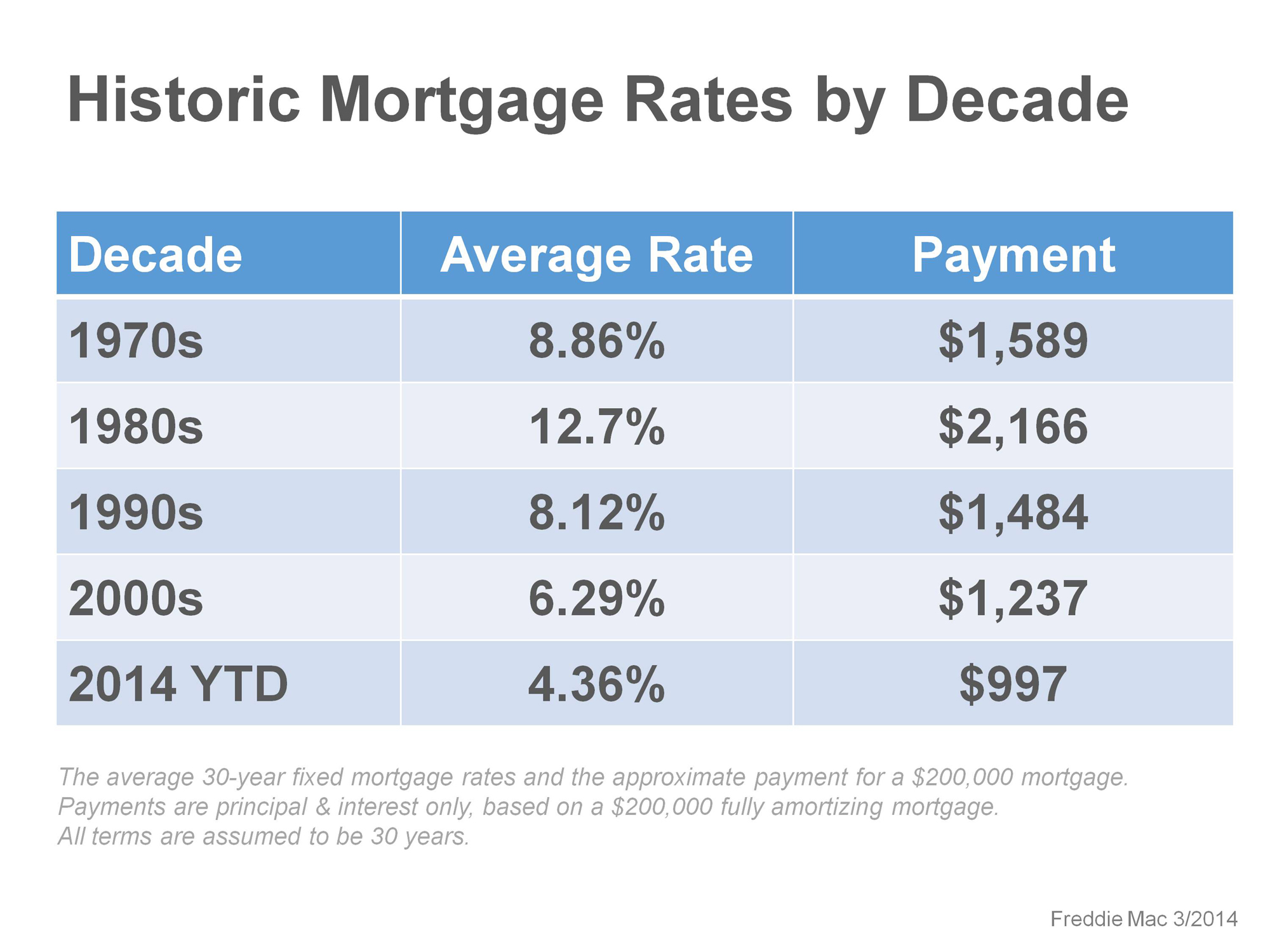

No Surprise – Rates will be going up – but when? By the end of 2015 Fannie Mae projects mortgage rates will be 5% while Freddie Mac's projection is 5.7% and Mortgage Bankers Association is 5.3%. The consensus is unanimous as to the direction of rates, the question is when. If Freddie Mac is correct with their projections the graph below is what we can expect.

You've heard it before – "Even a rate in the 5's is great when compared to historical levels" While this is true, I found the chart below helpful in providing perspective. It shows that rates affect the "cost" of housing. Significant shifts in how much a monthly payment costs a homeowner can happen with a swing in rates.

You've heard it before – "Even a rate in the 5's is great when compared to historical levels" While this is true, I found the chart below helpful in providing perspective. It shows that rates affect the "cost" of housing. Significant shifts in how much a monthly payment costs a homeowner can happen with a swing in rates.

Possibly the greatest buying opportunity of a generation that was created by the Great Recession will be something we all talk about in the future. How soon that day comes is yet to be determined but it is clear we are still in a great window of opportunity.

Possibly the greatest buying opportunity of a generation that was created by the Great Recession will be something we all talk about in the future. How soon that day comes is yet to be determined but it is clear we are still in a great window of opportunity.

Despite recent gains, Pierce County still remains 21% below the peak median price, couple that with rates in the 4's one can say that both the Price and the Cost of a new home are very attractive!

Despite recent gains, Pierce County still remains 21% below the peak median price, couple that with rates in the 4's one can say that both the Price and the Cost of a new home are very attractive!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link