Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Pierce County Housing Report 2016 Recap / 2017 Outlook

The U.S. economy is providing a very positive backdrop of low unemployment, new highs in the stock market, and housing appreciation is firmly on the march. Pierce County is also enjoying it’s share of good news and economic fortune, 2016 was a great year of continued recovery. Looking ahead, Pierce County has some serious considerations that will determine it’s future and the role it plays in our region’s economy. First, here are the end of year end numbers as measured December 31, 2016.

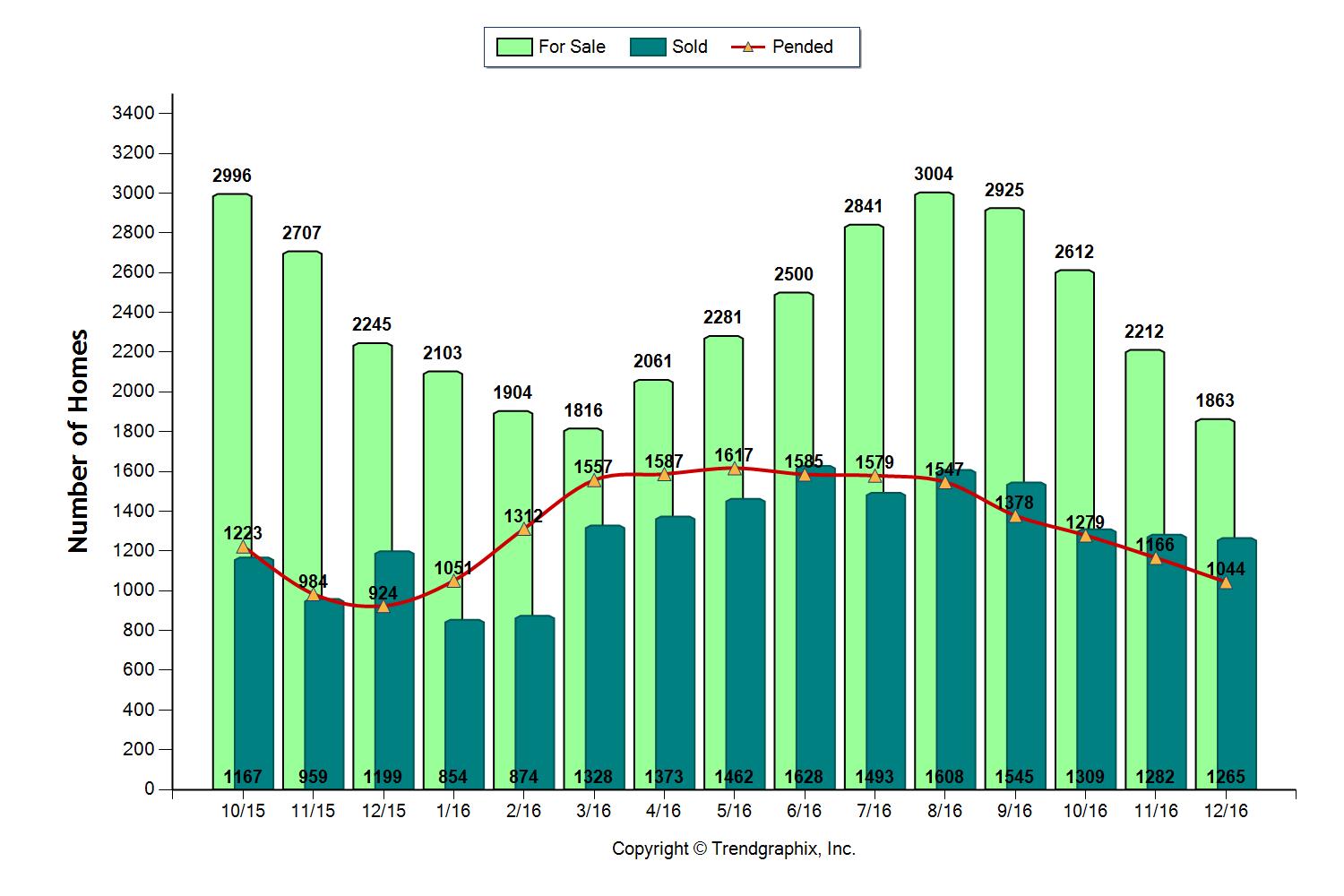

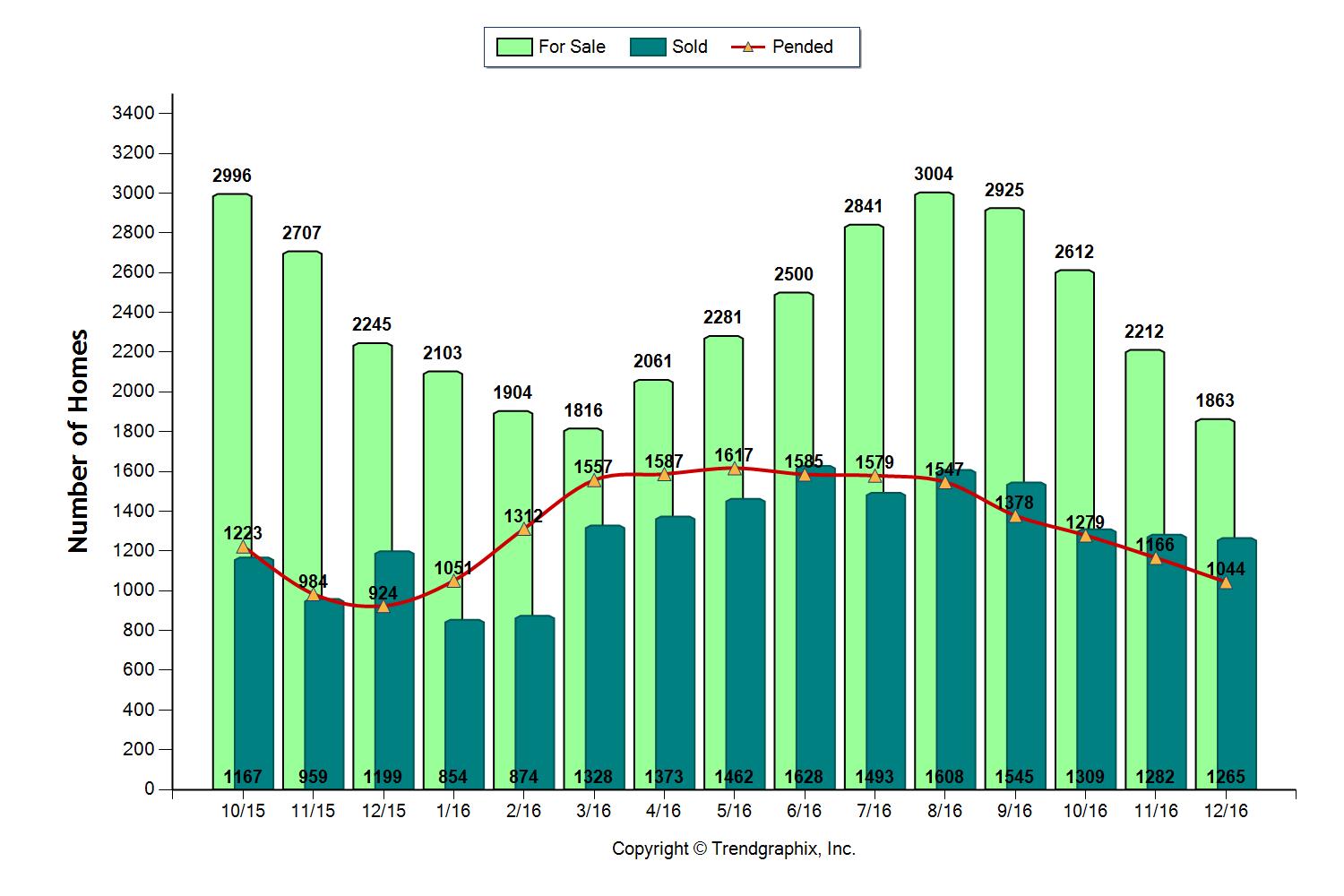

Inventory – DOWN – 17%

Closings – UP – 7.9%

Median Price – UP – 10.5%

New Pending Contracts – UP – 13.8%

Pierce County, by these numbers, has only 1.7 months worth of inventory. We consider 3-5 months worth of inventory to be a balanced market so there is clearly need of more homes to sell in order to satisfy current buyer demand.

Prices in Pierce County are up 26% in the last 3 years (compounded rate of 8% annually) and the median price has fully recovered from the great recession.

As shown by our Pierce County Median Price Index we are at our pre-recession peak. By comparison, King County prices are 13% above their previous peak. The affordability index in Pierce is fully 45 points better than King County.

This recovery in price also means we have far fewer homeowners with negative equity. When a homeowner owes a mortgage balance greater than their home value they have negative equity. In 2011 & 2012 we were seeing negative equity rates in Pierce County upwards of 26% of all mortgages. Measured in the second quarter of 2016 the rate was a much improved 9.7%.

Price recovery is accompanied with Velocity and Volume recovery. Last year Pierce County sold 15,082 residential units representing a 13% increase over 2015. This amounted to just over 5 billion in sales and is expected to top 6 billion in 2017.

I feel bad clouding this good news with the following, but it clearly is an issue that is relevant to the health and future of our Pierce County Housing Market.

Here it is: Jobs, Jobs, Jobs.

The King County market is red, no….white hot! Why? The King County number of jobs per resident is 207, in Pierce County the number of jobs per resident is 82. The unemployment rate in Seattle is 3.7% while in Pierce County it is 6%. Compare Pierce to U.S. with unemployment rate of 4.7% and see the weak recovery path in the graph below.

After each of the 3 previous recessions, Pierce County unemployment recovery was better. In the 90’s Pierce recovered to 4.5% unemployment, the pre-recession recovery was in the 5’s, while the current recovery has only reached 6% and it appears to be a post recovery low.

Pierce County’s per capital income is $45,000 and would not be that good were it not for King County jobs. We are fighting a trend of becoming a bedroom community.

Fully 135,000 Pierce County residents have jobs outside the county. Put another way, 40% of the non-military work force don’t work here.

The effect on real estate is the commuter buyer/renter is a big part of our market and will continue to be that way until Pierce County improves it’s workforce skill and attracts new businesses.

With the Pierce County shortage of inventory and the pressure of high prices in King County, homeowners in our area will enjoy another year of increased values, likely in the 9-10% range.

Buyers will need to be fully pre-approved, able to react quickly, and be open to the idea they will likely compete for their dream home.

Yes, it will be a good year for real estate in 2017, but there is work to do if Pierce County wants to be more than just a place for Seattle skilled workers and executives to come home and sleep until they can afford a home closer to their job.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link