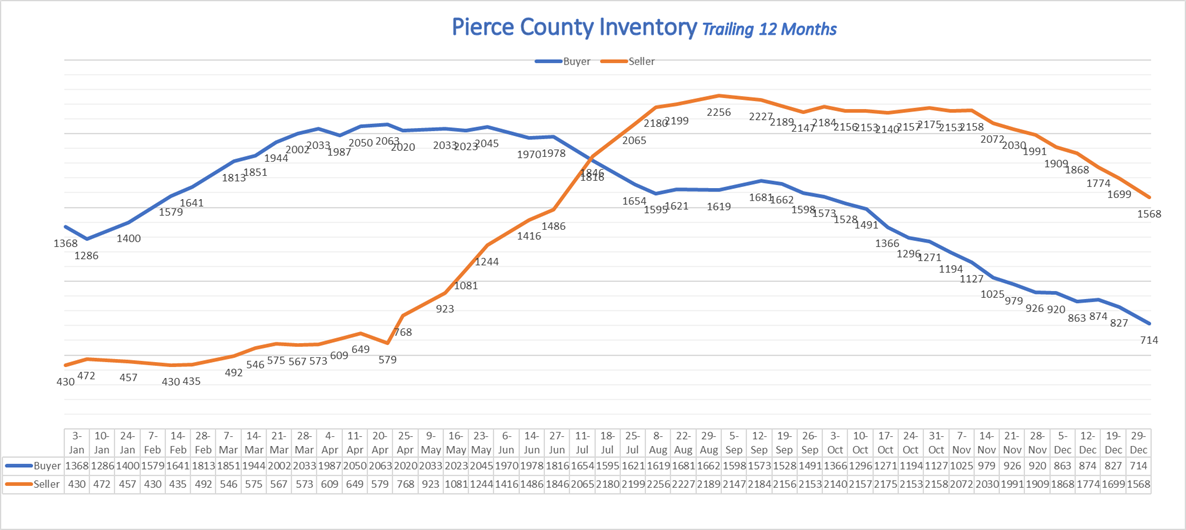

One year ago, as we entered 2022 the market seemed to be stuck on a track that was tiresome for buyers and brokers alike. The year began with only 430 homes & condos available throughout Pierce County. This situation, with not enough inventory, was not new. Buyers had to scramble after new listings quickly and offers for homes were streamlined with quick closings, attractive terms often above asking price and frequently with no inspections. The chance of selling a home in January of 2022 was 314%. In the simplest of terms, there were 31 buyers for every seller. This market inversion, with more buyers than sellers, had existed in Pierce County for several years. Many lamented for a more “balanced” market and we all knew the “seller’s market” of the ages was not sustainable.

We can now say that 2022 was a hangover year. A time to begin paying for the binging of years past, especially 2021.

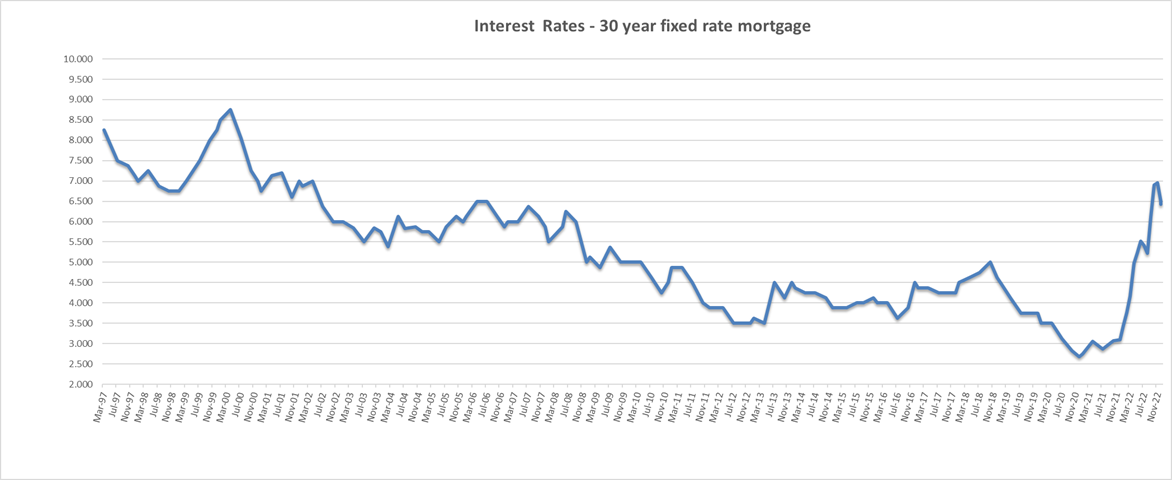

The red-hot market that existed at the beginning of 2022 was the result of many factors that finally boiled over after a record setting 2021. Looking back, the foundation for that robust market came from a Federal Banking Policy which started clear back in 2010. The Federal Reserve set their inter banking interest rate at zero which in turn allowed the banks participating in the home mortgage market to offer lower and lower interest rates for home purchases. That policy was intended to be a short-term fix to get the economy going after the housing crises, it was never intended to be in place for over a decade.

Now add a pandemic, pump $3 trillion new dollars into the economy, AND the overnight creation of a new “work from home culture.” Where and how people lived changed in record time, creating a tidal shift in housing everywhere including Pierce County. More importantly, the early 2022 economy was racing at unprecedented speed, and was starting to influence inflation numbers. Most economists in early 2022 believed the high inflation rate was going to be “transitory.” The economy just needed to digest all those new dollars, and everything would be back to business as usual. Unfortunately, the leaders at the Federal Bank believed those economists and waited to raise their rates. This has proved to be a big mistake. While they waited to respond to the inflation, the train was running away.

So now the Fed is fighting a bigger inflation monster than expected and they need to take measures far more aggressive than anyone hoped for. The way the Federal reserve fights inflation is by killing demand. Raising interest rates pours cold water on the economy, making it harder for businesses to expand, aka fewer jobs, and more expensive to buy things – like a new house.

Which leads me to where I started. A balanced market is what many yearned for when we were so out of whack with 31 buyers for every seller. Well, we now have a balanced market, but it tastes much more bitter than the sweet balance we imagined. The process of balancing the market has come from higher interest rates shocking the demand side of the buyer/seller equation. Better put, the demand is still there but many have been either priced out or simply refuse to participate and they are waiting to understand what happens next.

How did Pierce County real estate change from 2021 to 2022?

On June 27, 2022, Pierce County went from an inverted market with more Buyers than Sellers and began transitioning into a more traditional balanced market. Beginning the year with a 314% Chance of Selling, things stayed hot until the first Fed raise in March and then embarked on a steady regression to the norm. As the year winds up, we are seeing a 46% Chance of Selling, tipping in favor of buyers. Put another way, at the beginning of the year there was in theory an average of 31 buyers for every seller and now there is a ratio of only 0.5 buyers for every seller.

What happened with inventory + appreciation in 2022 in Pierce County?

Inventory was desperately low in Pierce County the last few years rarely reaching over 1,000 total units for sale at any given time, and had not been over 2,000 units since late August 2019. For 2022 we started out with that trend in place and began the year with only 430 available properties. That all changed as the Federal Reserve responded to inflation by raising the benchmark interest rate, slowly at first with a .25 increase in March, then becoming increasingly aggressive in subsequent intervals. With 7 hikes in 2022, by December the benchmark was at the highest level in 15 years. Further, it had not increased at such a fast pace in 50 years.

The purpose of the Fed raising rates is to fight inflation, the effect is it makes it more expensive to borrow money and therefore slows down the economy. It is doing just that with the housing market. Mortgage interest rates responded to the Fed hikes in 2022 and the days of the 3% mortgage are gone. The 30 year mortgage rate has settled for now within the 30 year average range at 6.42 as of 12/29/22.

With restricted demand, Pierce County’s steep price appreciation experienced in recent years flattened out in 2022, but not before it peaked in May at $575,000. The year began with a median price of $515,000 and through November was at $517,300 good for a sub 1% gain. Even with that correction Pierce median price is still up 57% over the last 4 years.

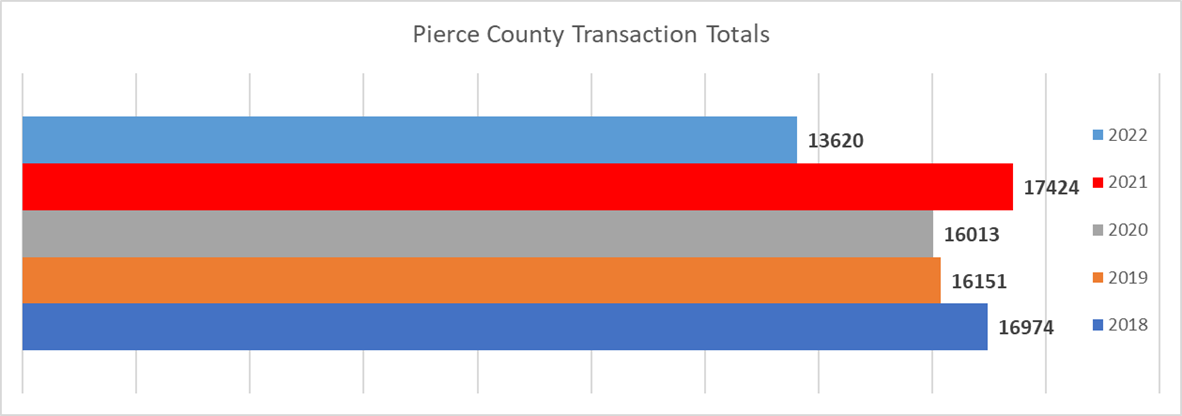

The transaction totals for Pierce County took a hit in 2022 coming in at 13,620 homes sold. This represents 82% of the previous 4 year average and a 22% decline from 2021.

What are the big real estate rumors right now, and is there any truth to them?

With so much change in such a short period of time, 6 months really, we’ve had a flattening of appreciation, an unprecedented increase in mortgage rates, and the buyer seller ratios flipping the table. It is easy to understand why some are shouting the “bubble is bursting.” There are several key reasons why this emotional response is not supported by data, and we are not facing a systemic drop in values. First, the demand for housing has not gone away. Household formation with the Millennial generation coming of age has never been higher. It is worth mentioning, this large segment of the population is larger than the Baby Boom population and currently some 4 million of them are turning 30 each year.

Second, while the final work from home policies are still congealing it is clear we will never go back to the 5 day 8 hour cubicle shifts in high-rises in downtown cores. People will want housing that allows them to work/study/learn and live in comfort which usually means a larger home with some space for this functionality. Many of those “part-time commute” jobs are in King County, while nearby Pierce County offers the same houses for less money. At the time of this writing PC’s median price was 32% less than King’s. This bodes well for Pierce values.

Another rumor crushing stat is the equity held by homeowners is at an all time high. Overall mortgage debt has remained steady over recent years while values have appreciated substantially. This shows in mortgage default rates well under 5% compared to rates of up to 40% during the financial crisis.

What do you anticipate for Pierce County real estate in 2023?

Yes, we will have a recession, but it will be mild and nothing compared to the 2008-2009 financial crisis. Economists, including Windermere’s Mathew Gardner predict mortgage interest rates will ultimately settle in the mid 5% range. That may happen by late spring, early summer, or take until as long as early 2024. In the meantime, competitive mortgage companies such as Penrith are offering loan packages that buy down the buyer’s rate for the first few years of the loan, and follow up with a fee-free refinance when the time is right.

Transaction totals for 2023 should come in around 15,000 units, still below the 5 year average but a 10% increase over 2022.

Is Q1 a good time to buy or sell?

The advantage to buyers in Q1 of 2023 is they are going to be able to buy at 2021 prices and enjoy less competition at the bargaining table than we’ve seen in recent years. Whether it is a good time to buy or sell is always a very personal question that depends on personal circumstances. That said, the future of residential real estate remains very strong for the long-term and if one’s plans include living here for the next 5 or so years, the financial reward promises to be good.

Overall, at least in the first half of the year, 2023 will follow the patterns set in motion during the last half of 2022. This means continued pressure from rising mortgage interest rates will restrict demand and create spot corrections of prices but no systemic decline. All eyes should be on the inflation numbers as that will dictate the continued Fed response. The sooner inflation is under control the sooner we can look for interest rates to stabilize for a few months. After that, the process of balancing the economy will continue, and we can start to look for rates to come down settling in the mid 5% range for the long term. Whether that happens in late 2023 or early 2024 is uncertain but the changes from here on out should come at us more slowly than they did in 2022 and that should translate to a calmer market that we can all enjoy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link