Month over Month Down + Year over Year Up = Just right!

What's ahead for 2014 and how long will distressed properties continue to play a part in Pierce County?

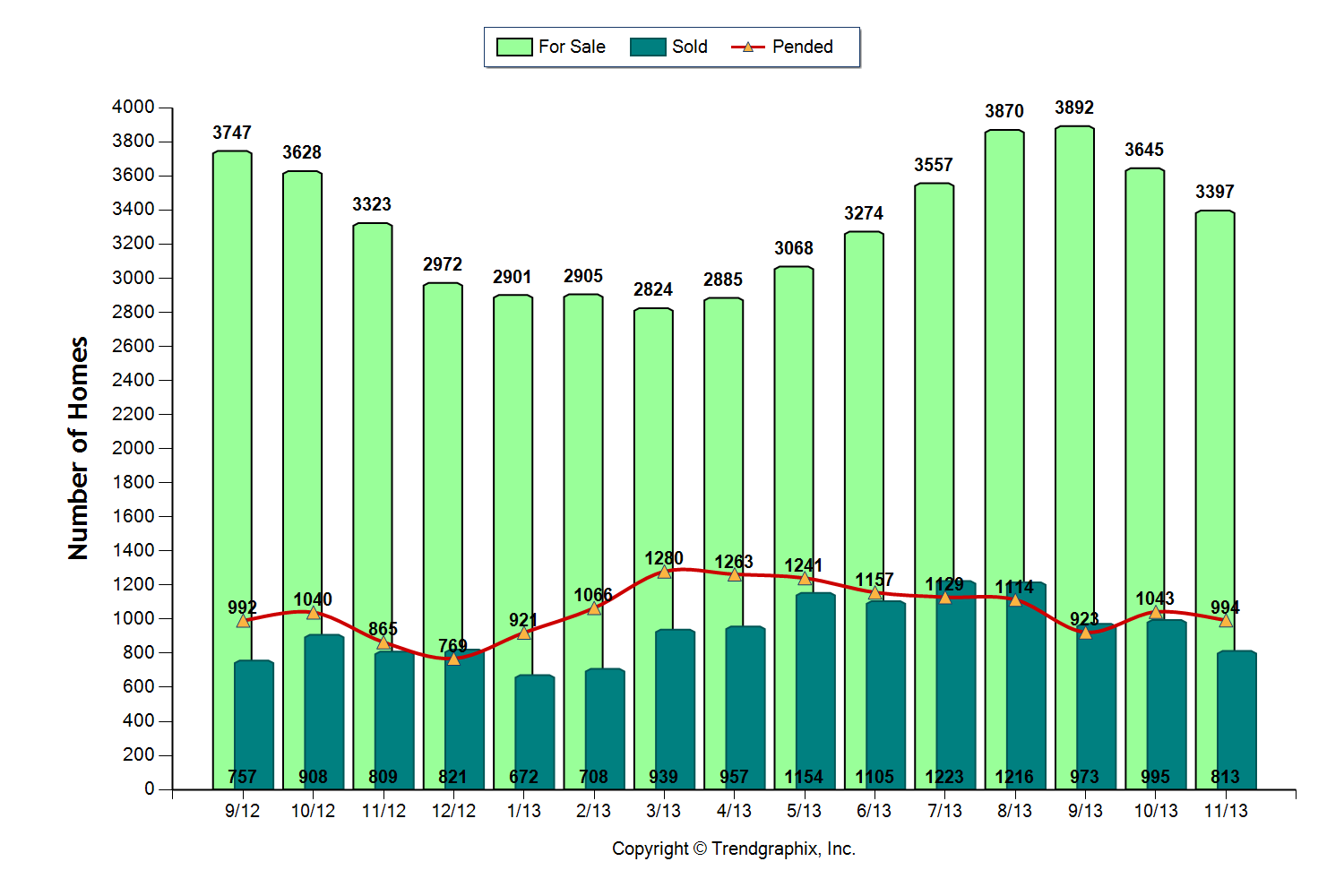

The Pierce County Housing Market took a breather in November when compared to the month before but the Year over Year stats continue to impress as we finish up 2013.

Here are the year over year numbers:

Inventory – UP slightly at 2.2%

Closings – Even up 0.5%

Months of Inventory – Even last year 4.1 this year 4.2

Median Price – UP 2.5%

All of the aforementioned numbers are Down from last month, notably the drop in Solds when compared to October was -18.3%. As I reported in my last installment; October benefited from upward lift created by the ending of the government shutdown. We can conclude while 18.3% is a hefty drop, the sky is not falling and big picture numbers look good!

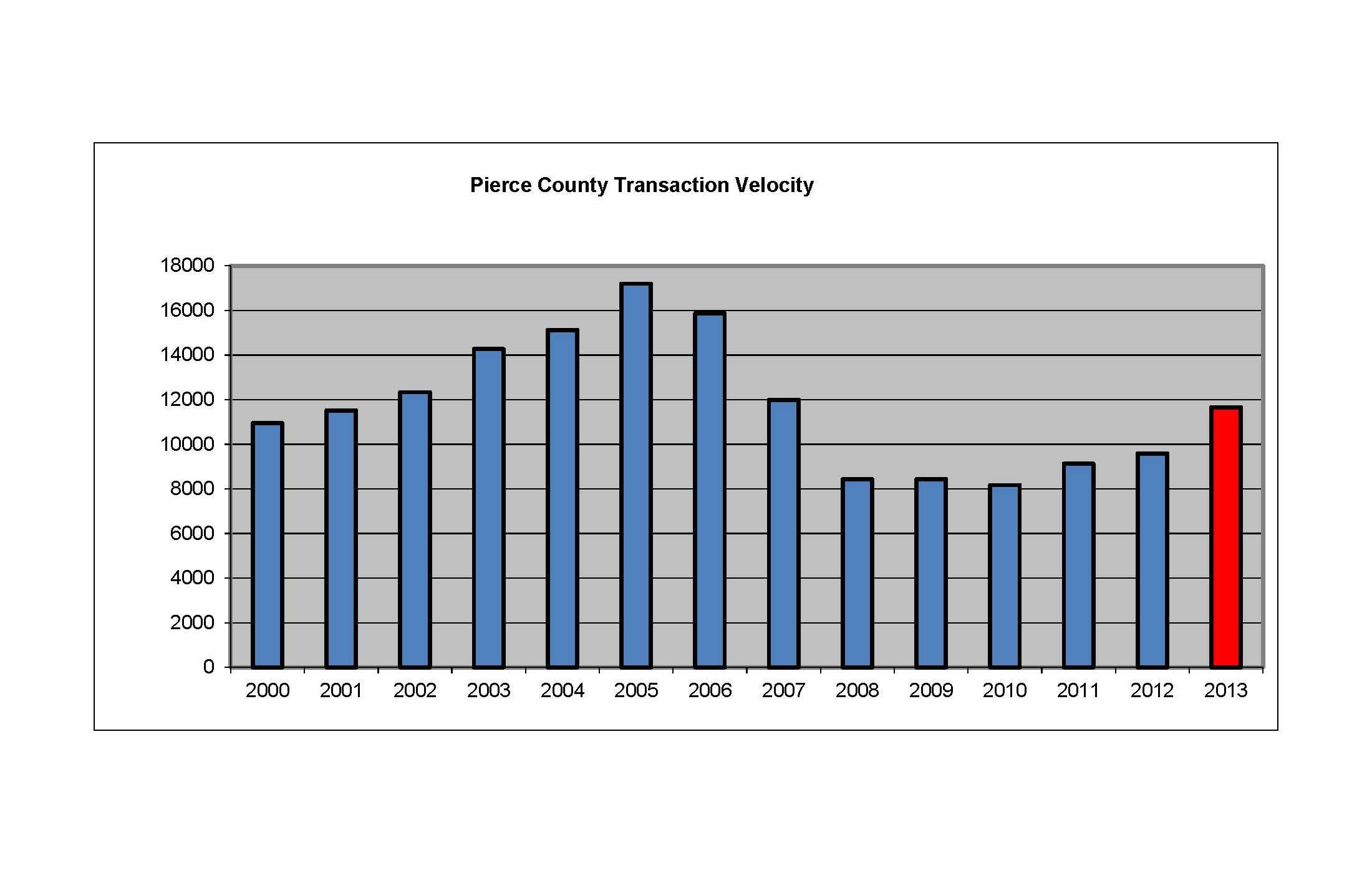

Transaction Velocity For several years I have said that the market recovers in two ways – and one is always before the other. First is transaction velocity. The transaction velocity, or volume, is the total number of units sold. This velocity must come back into line with the traditional norm before we can have a full recovery and further price appreciation. Now that 2013 is nearly in the books we can project Pierce County transaction velocity will come in just under 11,000 units. That compares to a 12 year pre and post bubble average of 12,749 . The chart below illustrates the fluctuations. Velocity for 2013 will be 12% greater than 2012 and that was accomplished with a relative short supply of inventory during the Spring and early Summer season. In 2014 Pierce County transaction velocity is expected to increase at least another 12% over 2013. That will bring the transaction velocity completely in line with the 12 year average.

Prices and Distressed Properties We are in a solid place for continued appreciation with transaction velocity approaching pre-bubble levels. Pierce County has also recorded 6 straight Quarters of Year over Year median price increases. Using the November median price of $205,000 Pierce County prices have increased 8% year to date, which is interesting because in August we were up 18.4%. One of the culprits preventing more robust increases in our area might be the quantity of distressed properties. As I discussed in October's report, distressed properties are either short sale or bank owned properties. In Pierce County 25% of the listings are distressed and nearly 1 out of every 3 real estate sales (32%) are distressed. As a percentage of volume, Pierce County has roughly twice the amount of distressed sales when compared to King County where 17% of the listings and 15.8% of the closings are distressed.

King County's distressed properties for sale equals a 2.5 months supply. Pierce County has 3.2 months which isn't that much worse. I don't want to over complicate but most of my stats come from the NWMLS….Pierce County has experienced heavy buying activity from numerous hedge funds snapping up hundreds of units that would otherwise be visible and counted here as additional distressed units Since those acquisitions don't hit the MLS we don't see them. According to CoreLogic the Washington State average of distressed inventory is between 6-8 months and you can see on the chart below how that compares nationally. As we work through 2014 we will be watching for the flow of distressed properties to eventually slow and this will signal even greater appreciation ahead.

We are wrapping up this year in a much different place than we were a year ago. Instead of hopeful optimism of a full recovery in the housing market we have many solid statistics to assure the trending is real, the bottom is well behind us, and real estate is showing itself once again to be one of the best long term investments available to all of us.

As real estate professionals we recognize there are still many Pierce County households who remain in recovery mode, for those, 2014 should bring relief with further price increases. For investors, the flow of distressed properties is an opportunity we may not see again for a long time. For those who would like to move up to a larger home, a waterfront, or a view home, ponder these elements:

– Mortgage rates remain at an all time low

– Pierce County prices have not yet fully recovered

– The market fundamentals strongly indicate "this recovery has a future".

Add it up and your next home can be bought with the confidence that it will be a rewarding investment.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link