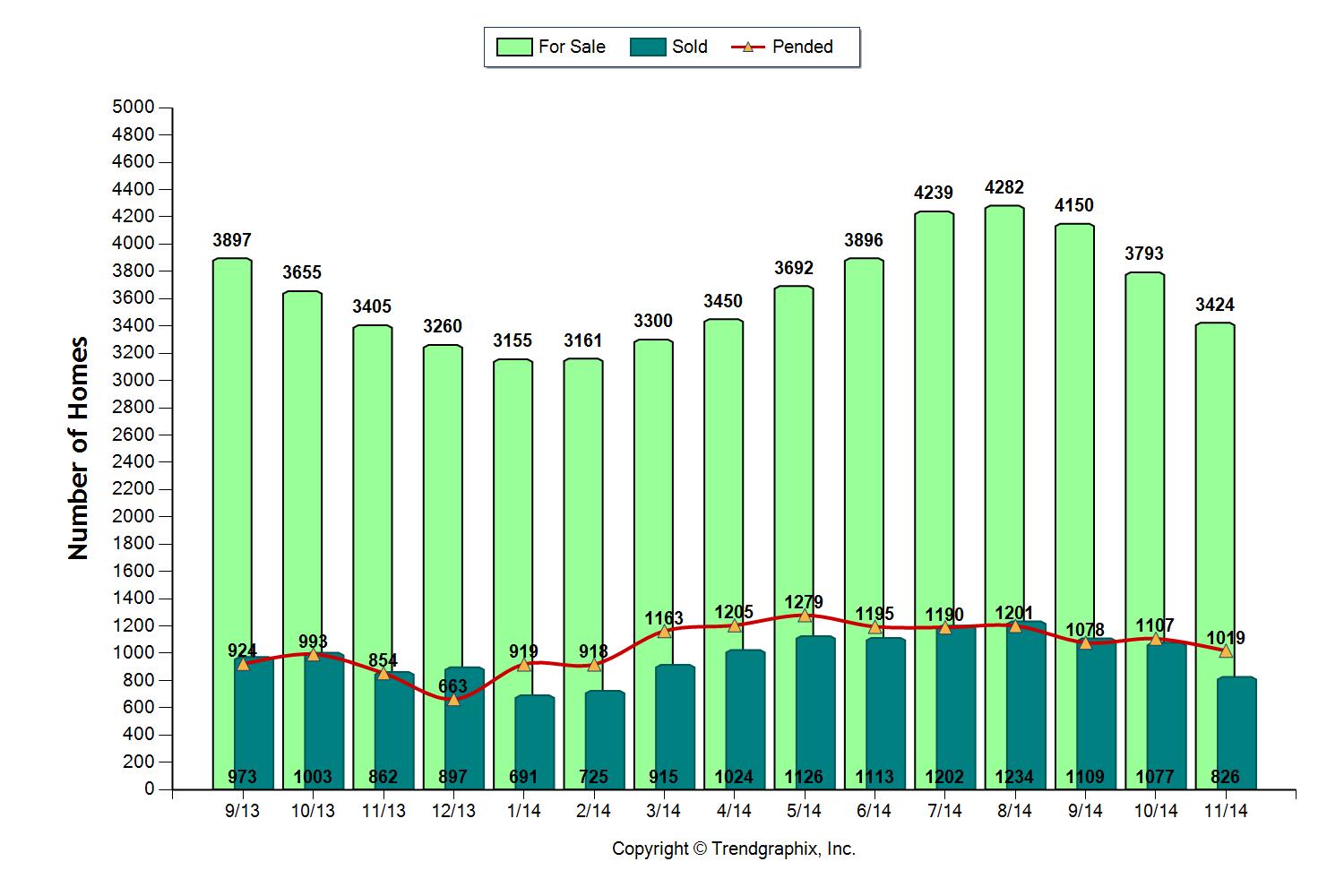

For the final Pierce County Housing Report of 2014 I thought it would be interesting to list 3 top trends that surprised in 2014. But first, let's look at the current headline numbers as measured on November 30:

Inventory – UP – 0.6%

Closings – DOWN – 4.2%

Median Price – UP – 14%

New Pending Contracts – UP 19.3%

A nice bump up for prices, flat growth in inventory, and surprisingly, closings down just over 4%. I say surprising because Octobers report was down over 30% in Pendings. The increase in year over year pricing contrasts with a 0.4% increase over last month and a 0.4% decrease from 6 months ago. This deceleration of price increases matches what we are seeing with National trends, and indicates a settling of the market.

Three Top Trends for 2014.

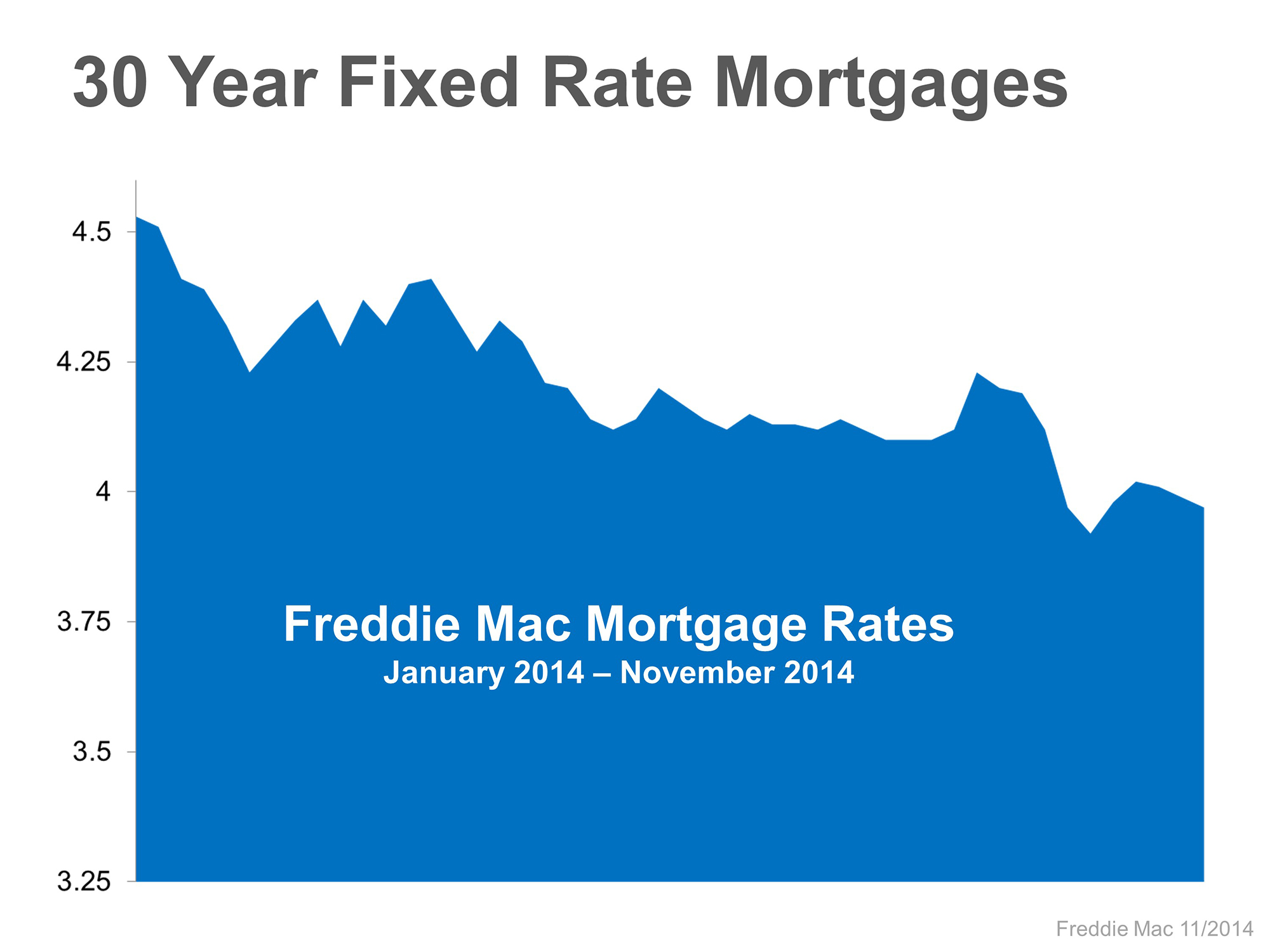

1. Interest Rates. Most all real estates pundits, including yours truly, predicted we would have interest rates back up to around 5.5% by this time. Luckily for home buyers and sellers not only did rates not tick up in 2014, they actually trended down! As of this writing the 30 year fixed rate is at 4.125%.

These low rates make it easier for buyers to qualify for the house they want and provide a great hedge against the likelihood of future inflation. Locking in a housing expense at these rates will prove over time to be a great move for a anyone interested in a long term real estate hold.

Just like one year ago, all the experts are calling for a rise in rates to take place over the coming 12 months. Here is a chart indicating where the major mortgage providers and experts predict rates will go.

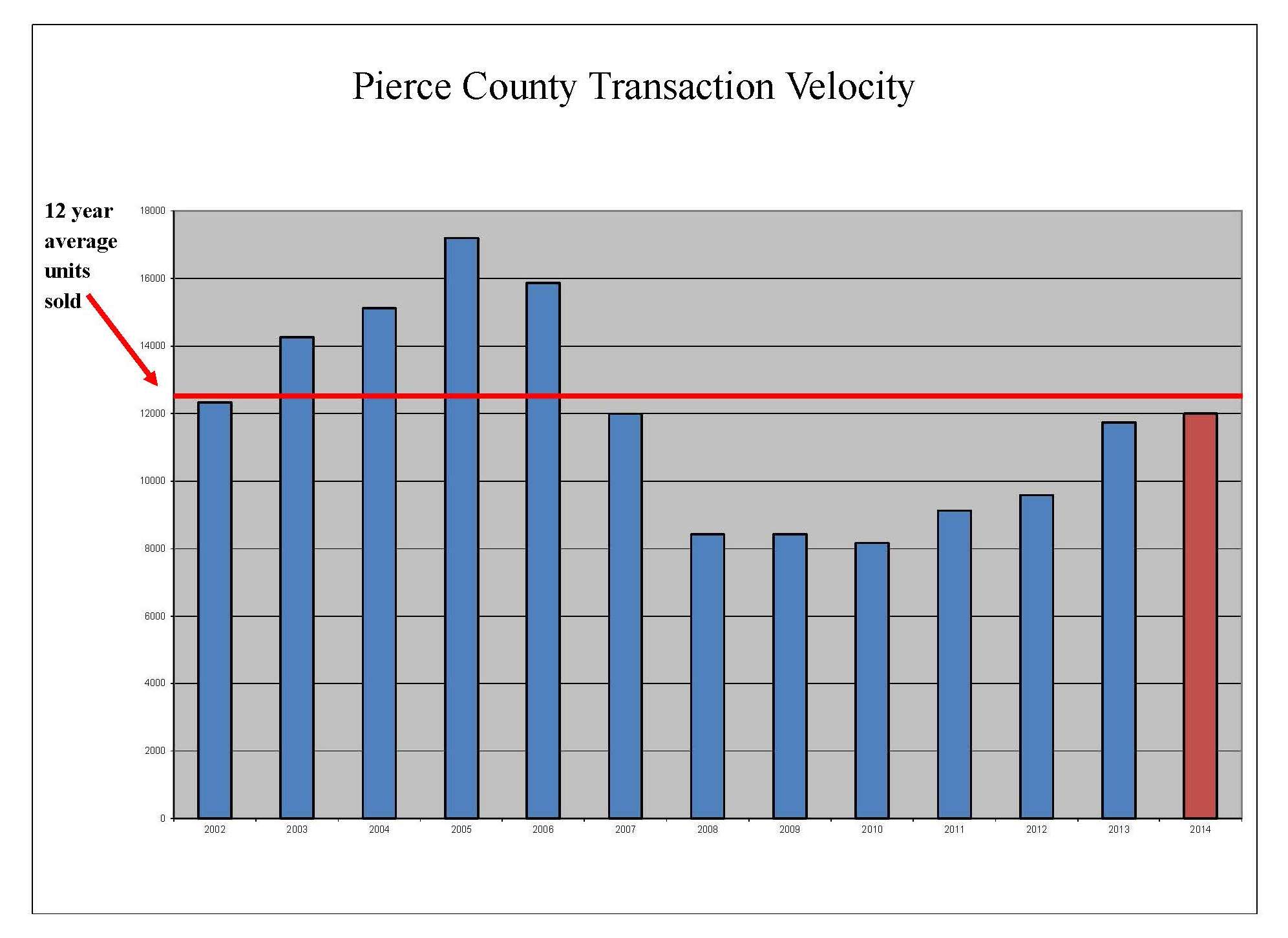

2. Transaction Velocity. In several of my past reports I've stated, "the pace of transaction velocity must come back before a market can fully recover". In 2014 Pierce County will record something right around 12,000 units. The 12 year pre and post bubble average is 12,749 units Sold annually in Pierce County. It is exciting to see our market returning to these historical average levels.

3. Decrease in Distressed Property Sales Distressed property sales are those sales that are either Bank Owned (REO) or Short Sales where the owner owes more than the market will bear. Compared to our King County neighbors we have had more distressed property sales as a percentage of our total volume throughout the recession and recovery. By looking at the chart below we can see a trend of clearing these properties, another important step to normalizing our appreciation forecasts.

3. Decrease in Distressed Property Sales Distressed property sales are those sales that are either Bank Owned (REO) or Short Sales where the owner owes more than the market will bear. Compared to our King County neighbors we have had more distressed property sales as a percentage of our total volume throughout the recession and recovery. By looking at the chart below we can see a trend of clearing these properties, another important step to normalizing our appreciation forecasts.

As measured by comparing November 2013 to November 2014 we see distressed property sales accounted for 31% of all closings in 2013. In 2014 the distressed property sales accounted for 22%. The percentage of total inventory also declined from 25% to 19%. As this inventory continues to clear we will get back to normal levels of 5% to 10% and it will cease to provide a drag on price increases in the future.

Thanks for your interest in this report and I hope your home is filled with good friends and family this Holiday Season!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link